Top News On Picking Credit Card Apps

Wiki Article

How Do I Check To Find Out If My Credit Cards Were Reported As Stolen?

Follow these steps: 1. Contact the credit card company that issued your card.

Call the customer service number on the back of your credit card.

Inform the agent of your intention to determine whether or not the credit card was reported stolen or lost.

Verification may require you to supply specific information about yourself, including the number on your credit card and name.

Verify Your Online Account

Log in to the account of your credit or debit card or online banking which matches the card.

You can monitor for alerts, notifications and messages regarding the status your credit card.

Review recent transactions to find any suspicious or unauthorised transaction that is suspicious or unauthorized.

Keep an eye on Your Credit Report

Obtain a free copy of your credit report from each of the three major credit bureaus (Equifax, Experian, TransUnion) through AnnualCreditReport.com.

You should look over your credit reports for suspicious requests or credit accounts.

Fraud Alerts, Security Freezes and other measures

You may want to consider placing a credit freeze or fraud warning on your credit report in the event of fraud or identity theft are suspected.

A fraud alerts lenders to confirm your identity prior to giving credit. The security freeze in contrast, restricts your access to your report.

Report any suspicious activities that are suspicious.

Check your credit card statements frequently and inform your card issuer of any transactions that appear suspicious or not authorized.

Inform anyone who suspects identity theft or fraud to the Federal Trade Commission. Also submit a complaint to the local police department.

By contacting your bank, checking the history of your account online, keeping track of the state of your credit score, and staying alert for warning signs of fraudulent transactions, you can prevent credit card fraud.

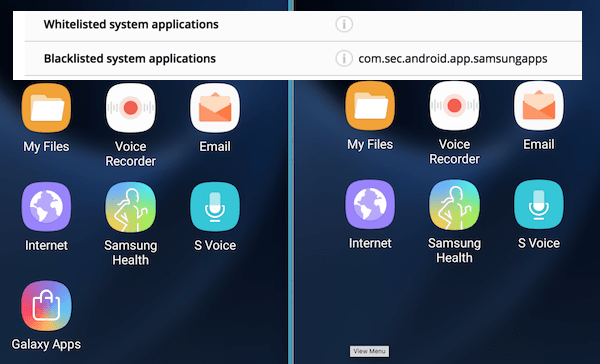

What Should I Do If I Suspect That My Credit/Debit Card Is Blacklisted?

You must follow the steps below if your credit card appears on a list or if there is suspicion of fraudulent activity. Contact Your Credit Cards Issuer Immediately

Contact the customer support number located on the back of your credit card. Also, visit the official website of the issuer for a hotline for reporting fraud.

Inform the bank that issued your card of the concerns you have. Declare you believe there is a fraudulent transaction on your card or that it could have been compromised.

Report Suspicious Activity-

Please explain the unusual transaction or unauthorized purchases you've seen on your credit card statement.

Please provide specific information about the transaction you're unsure about. Include dates, the amount and, if applicable, merchant names.

Request Blocking of cards, replacement or Replacement

You can request the company that issued your account to stop future fraudulent transactions.

For continued credit access For continued credit access, ask about the procedure for replacing your card.

Review Your Account and Dispute Charges-

Check your most recent transactions and statements for any other suspicious activities that you may not have noticed at first.

You can report unauthorized transactions to the card issuer so that they will be investigated and then resolved.

Be Watchful and Monitor Your Credit Report

Make sure to contact your credit card company to find out whether the issuer has taken the appropriate steps to address any issues you might have.

Always monitor your credit card account for suspicious or unusual or unusual activity.

You might want to consider putting up a fraud alert or security freeze-

You might want to consider placing a security freeze or fraud alert on your credit report depending on the nature of your circumstance. This will prevent additional fraudulent attempts and help protect you against identity theft.

Report to Authorities If Required

The report of identity theft to the Federal Trade Commission or filing an investigation with local law enforcement authorities is recommended if you suspect that you have been the victim of a significant fraud.

To minimize losses and stop further unauthorized transactions It is crucial to act quickly. Reporting suspicious transactions and working closely with your card issuer can aid in minimizing the effects of the possibility of fraud or misuse.

Cybersecurity Experts Are Educated To Detect And Monitor Cyber-Security Threats, Such As Credit Card Information.

Security experts employ a variety of techniques, tools or methods to identify, monitor and identify cyber-attacks. This includes stolen credit card information. Below are a few of the more common methods.

Collecting information from a variety of sources, such as threat intelligence feeds, forums and dark web monitoring and security advisory to stay informed about the latest security threats and vulnerabilities.

Network Monitoring and Intrusion Detection-

Use software designed for monitoring the network's traffic and identify anomalies and suspicious activity that could indicate an unauthorised access to data or breach of.

Assessments of vulnerability and penetration testing

Regular checks are conducted to find weaknesses in applications, systems or networks. Testing penetration tests mimic attacks in order to identify vulnerabilities and assess the security capabilities of an organization.

Security Information and Event Management System (SIEM),

Implementing SIEM Solutions that combine and analyse log data from various sources (such servers, firewalls and applications), to detect and react in real-time to security incidents.

Behavioral Analytics -

Utilizing behavioral analysis to identify any patterns that are unusual, deviances or abnormalities from the normal user behaviors within networks or systems that could indicate a possible security breach.

Threat Hunting

Looking for suspicious or threats activity on the network of an organisation using logs, data and system information. This may help to identify threats that have eluded traditional security methods.

Endpoint Security Solutions

Endpoint security tools (such as anti-malware and endpoint detection and reaction tools) are deployed to protect devices and their endpoints from the threat of malicious actions.

Privacy, encryption, data protection and Privacy-

Secure sensitive data, such as credit card details while they are both in transit and while at rest.

Incident response & Forensics

To be able to respond swiftly to security breaches, it is important to establish and implement plans for responding to incidents. Conducting forensics in order to comprehend the consequences and quantify them of security breach.

Cybersecurity professionals combine these approaches and a deep knowledge of cyber-related threats and compliance regulations, as well as best practices, to proactively recognize and combat cyber-attacks. This includes incidents involving compromised information from cards. To be able to defend yourself against cyber-attacks it is essential to keep up with continuous surveillance, information and an active approach. See the recommended savastan0 cc shop for more tips.